Happy new year everyone! I am doing a rush post on holiday to get y’all informed about this new feature that was released on the most recent update of the UnionBank App.

Every new year comes we always promise to quit our bad habits and start developing a good one or more. But as always, we tend to lose on track because we don’t even track our goal progress at all.

I’m pretty sure that saving up is one of the top priorities of everyone this coming new year. We always tell ourselves that we’ll save for investment, dream house, business, vacation, school funds, and new gadgets. If you’re someone like me who tends to forget about committing on saving-up goal because of any reasons then this new Goal feature of Unionbank’s app is definitely for you too.

Why setting financial goals this 2021 with UnionBank?

I carry all financial responsibility for my family and honestly, my income always goes to paying bills and family expenses. So far, I am only able to buy other things when I receive extra income.

I am an impulsive buyer so when an extra income appeared I tend to lose it onto something unimportant. I always forget about saving up since whenever I see extra cash on my pocket or my account I tend to spend it. Not cool!

So here are are some reasons why this goal feature is perfect for me and I believe for everyone:

- You can choose or set any kind of financial goal.

- You can set up an auto-debit from your Unionbank account for as low as 500 PHP

- They have 3 auto-debit frequency option ( Weekly, Monthly and Quarterly )

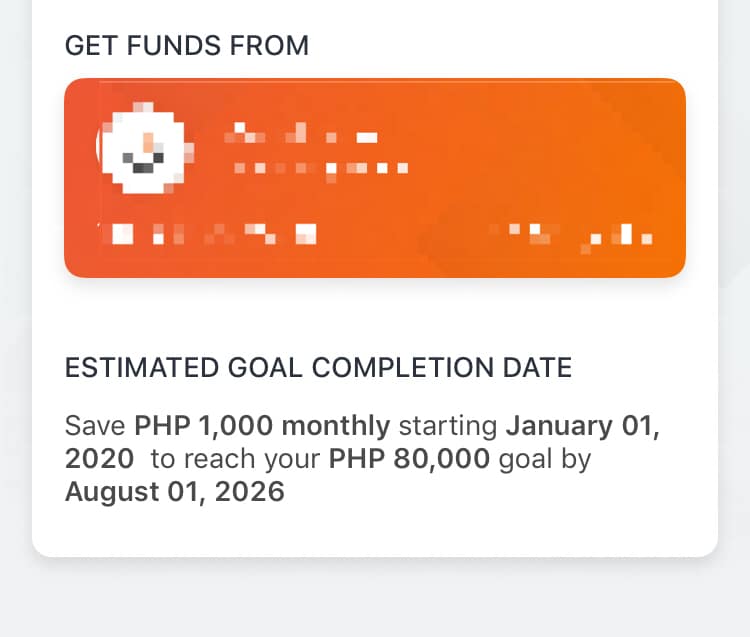

- Setting up a start date will allow you to see an estimated time when you can reach your goal.

- There’s also an option to top-up your Goals’ account. This means I can put my extra income here for faster progress.

Types of Goals on UnionBank App

How to set up financial goals on UnionBank App

A step by step guide on how to set up a financial goal on the UnionBank App

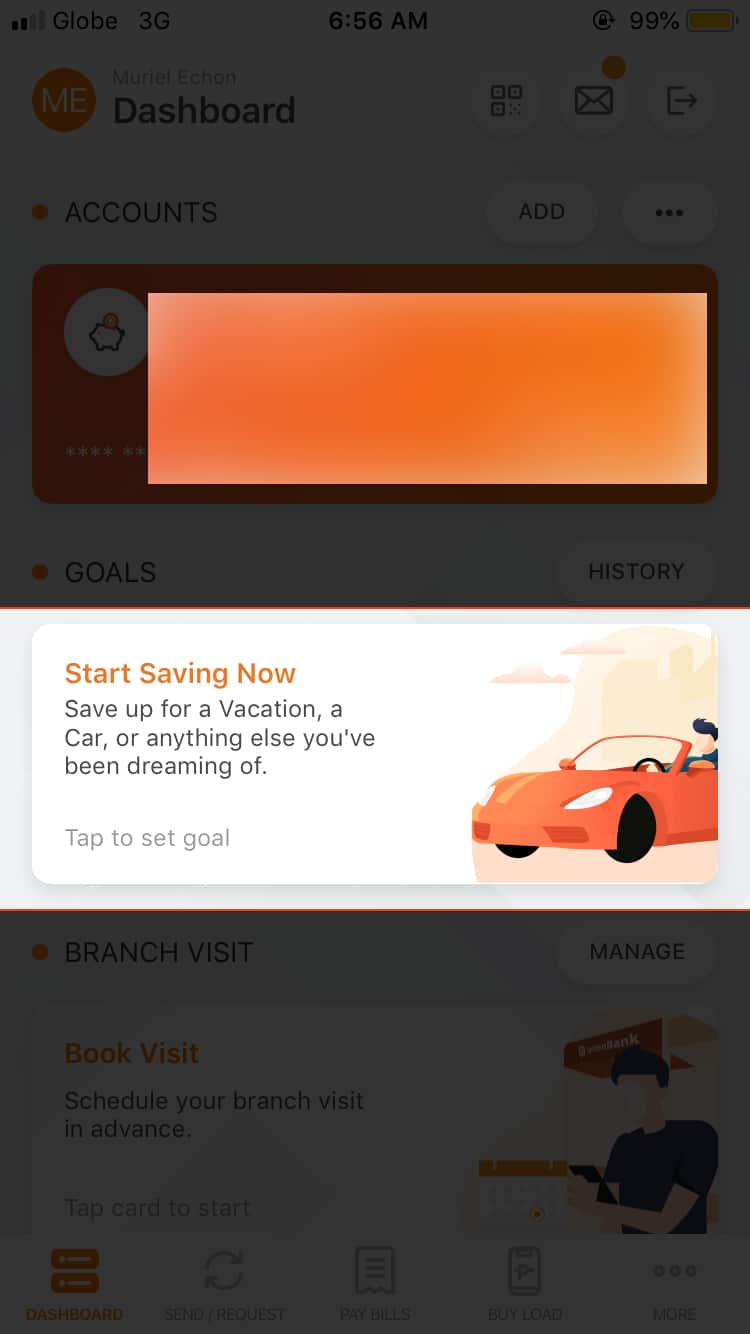

Click Start Saving Now to get started with your Goals

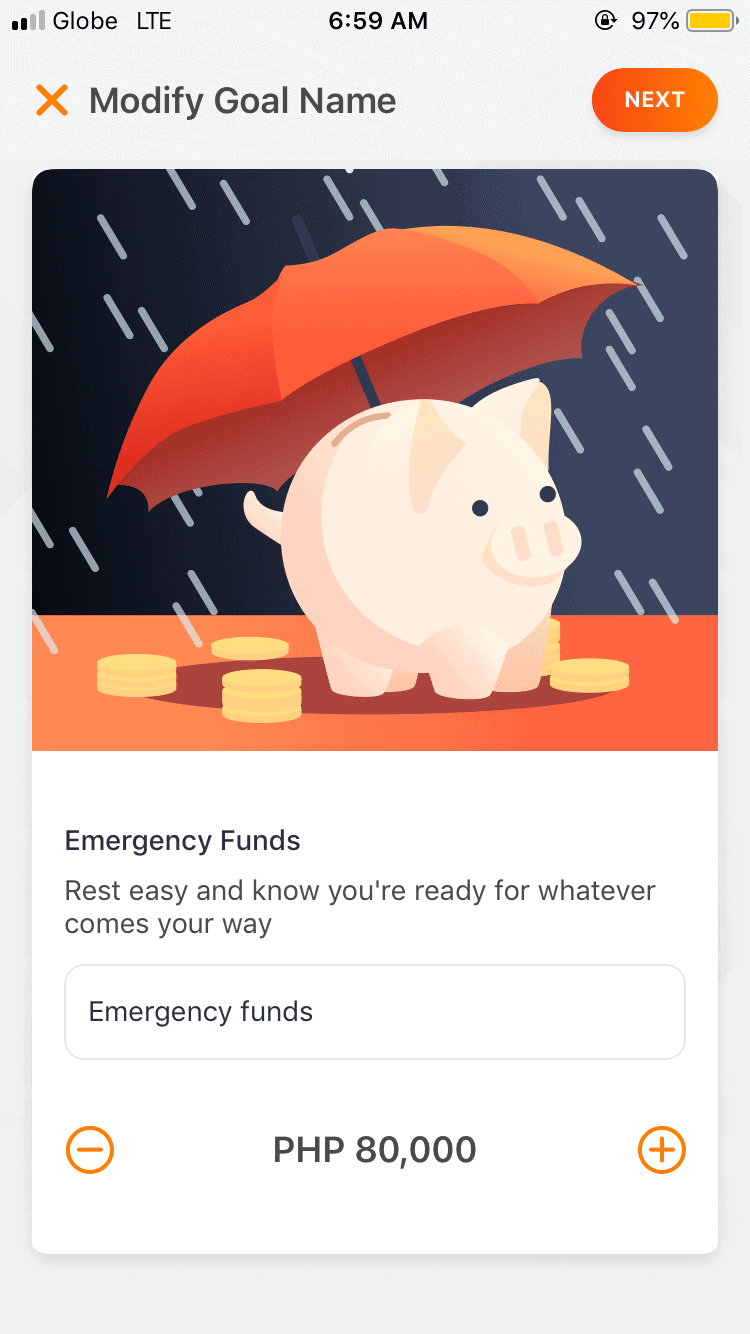

Select your Goal, Name it and set the amount

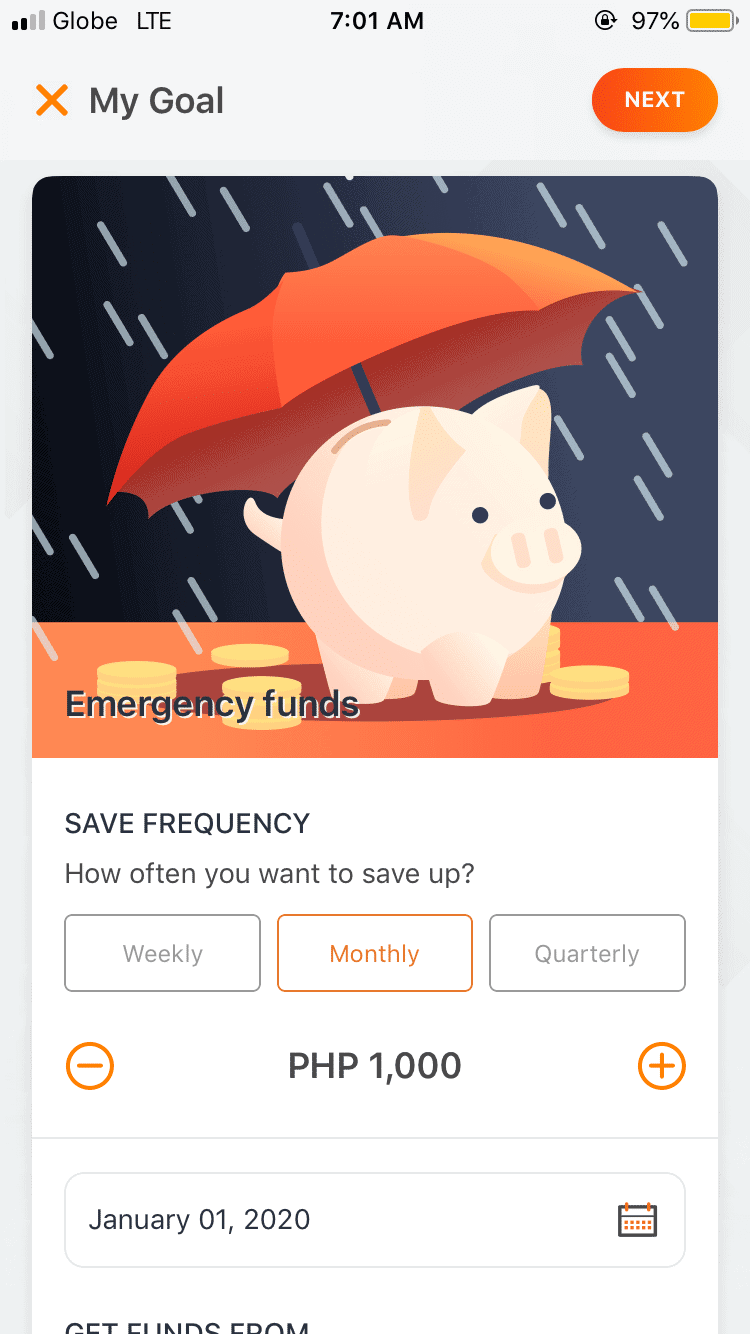

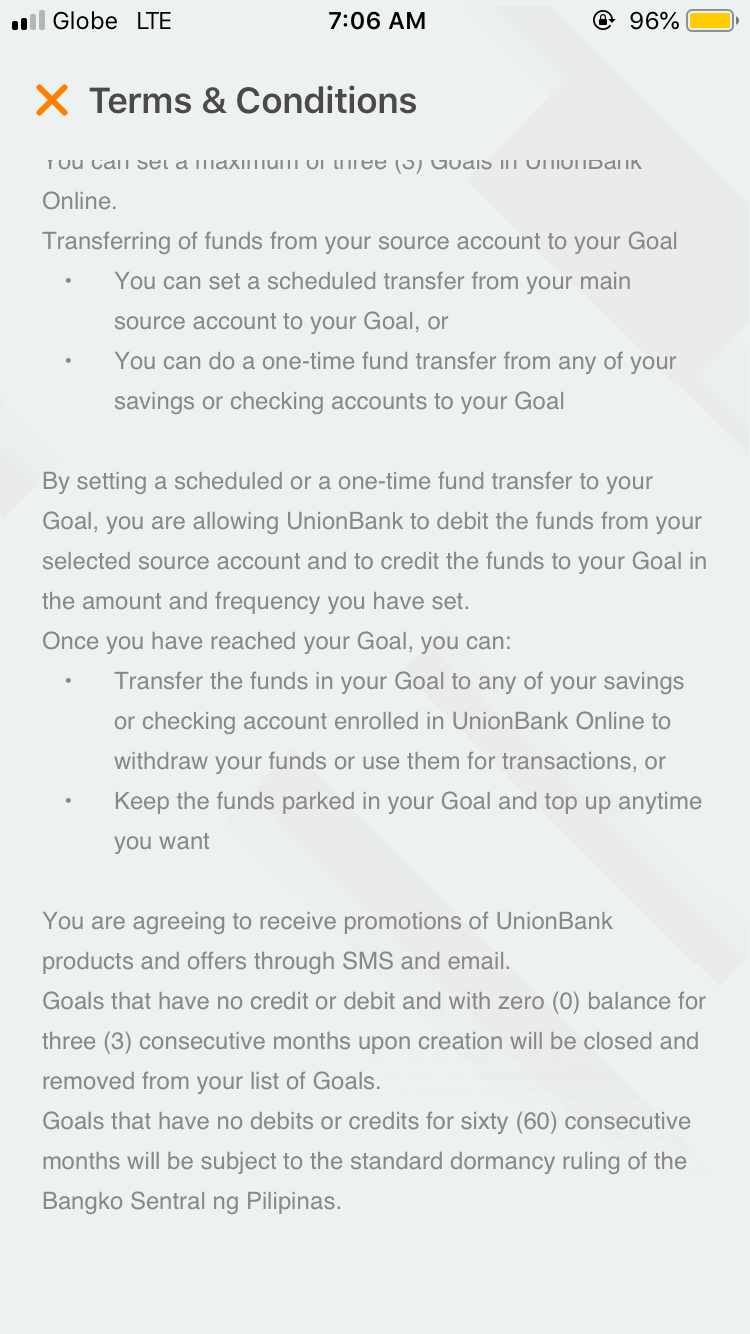

Choose your preferred frequency

Select which account should be auto-debited

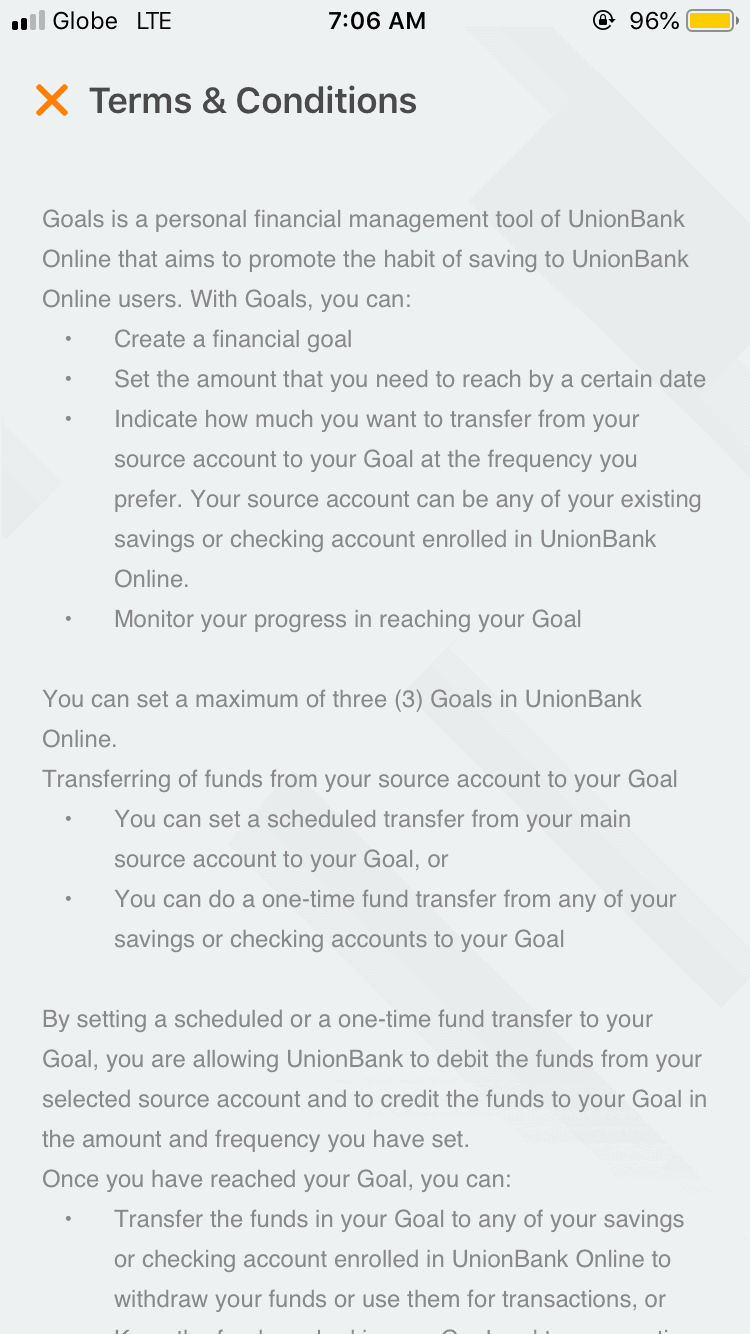

Review the Terms and Conditions

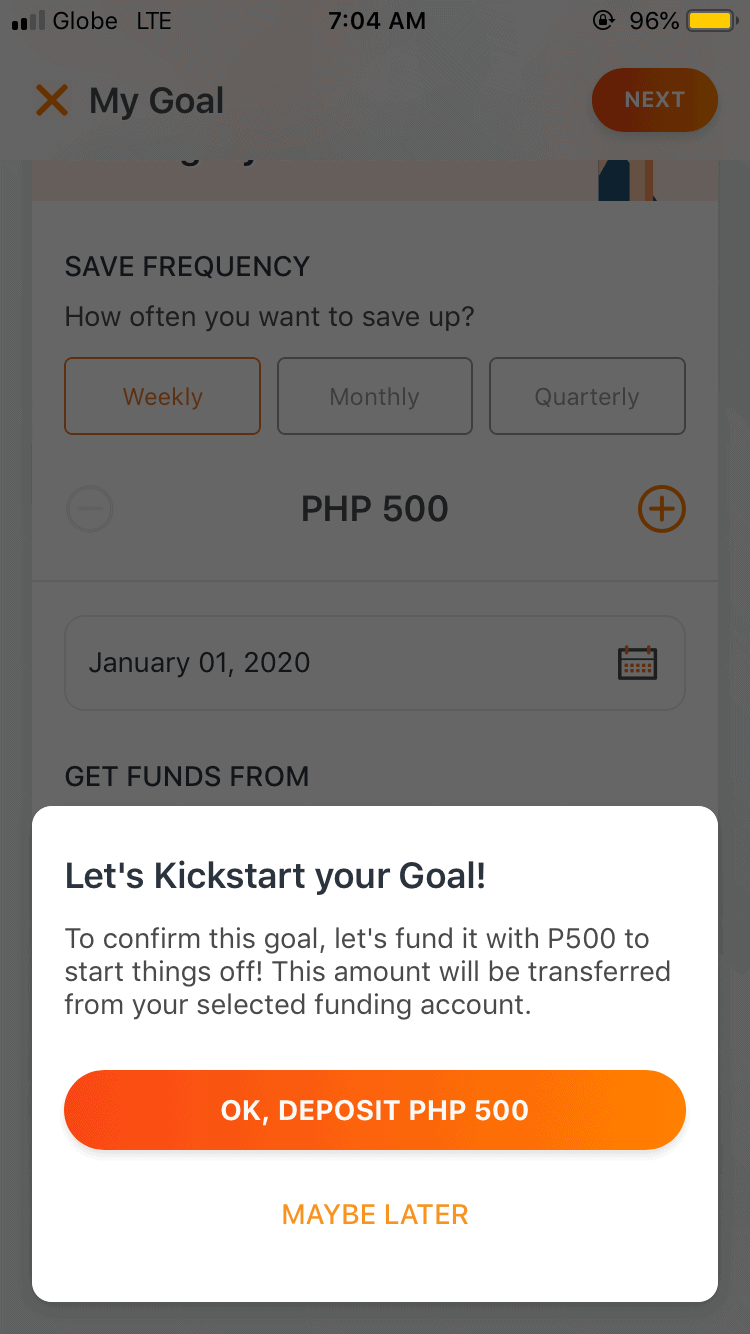

Get started by depositing at least 500 PHP (Optional)

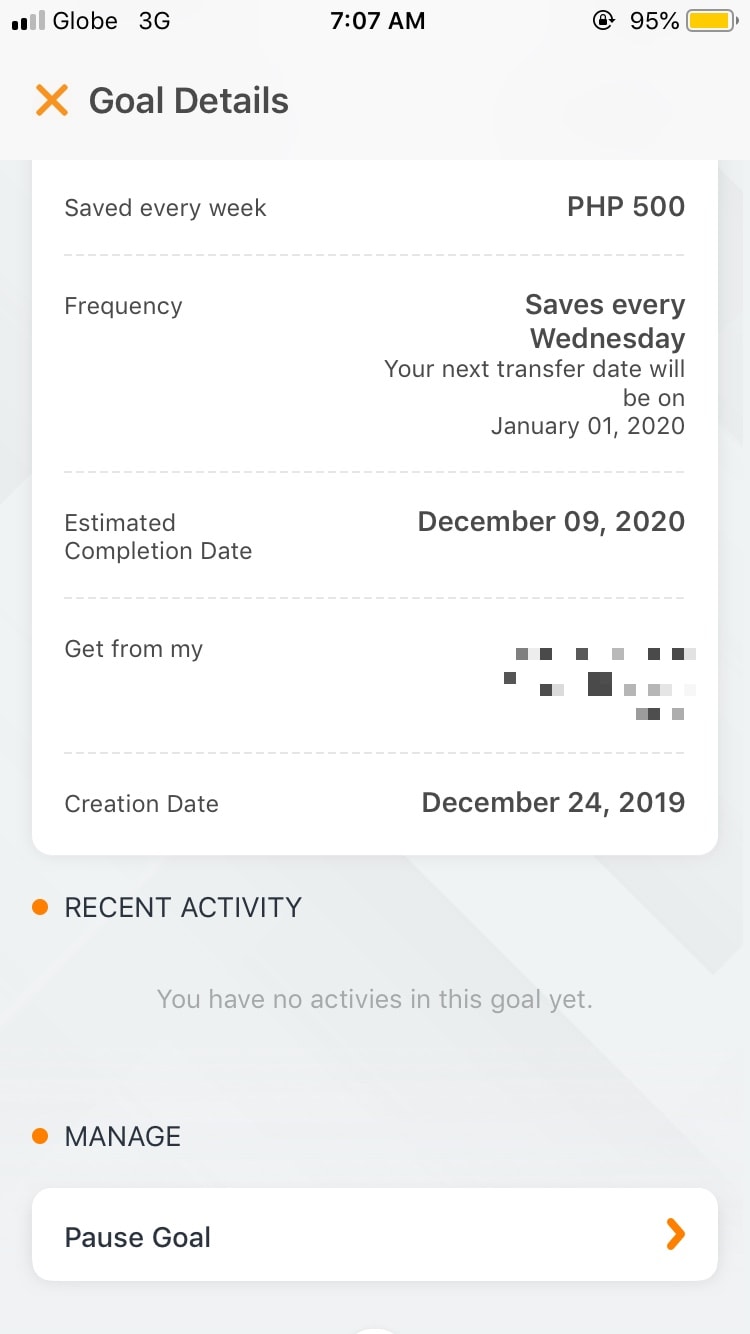

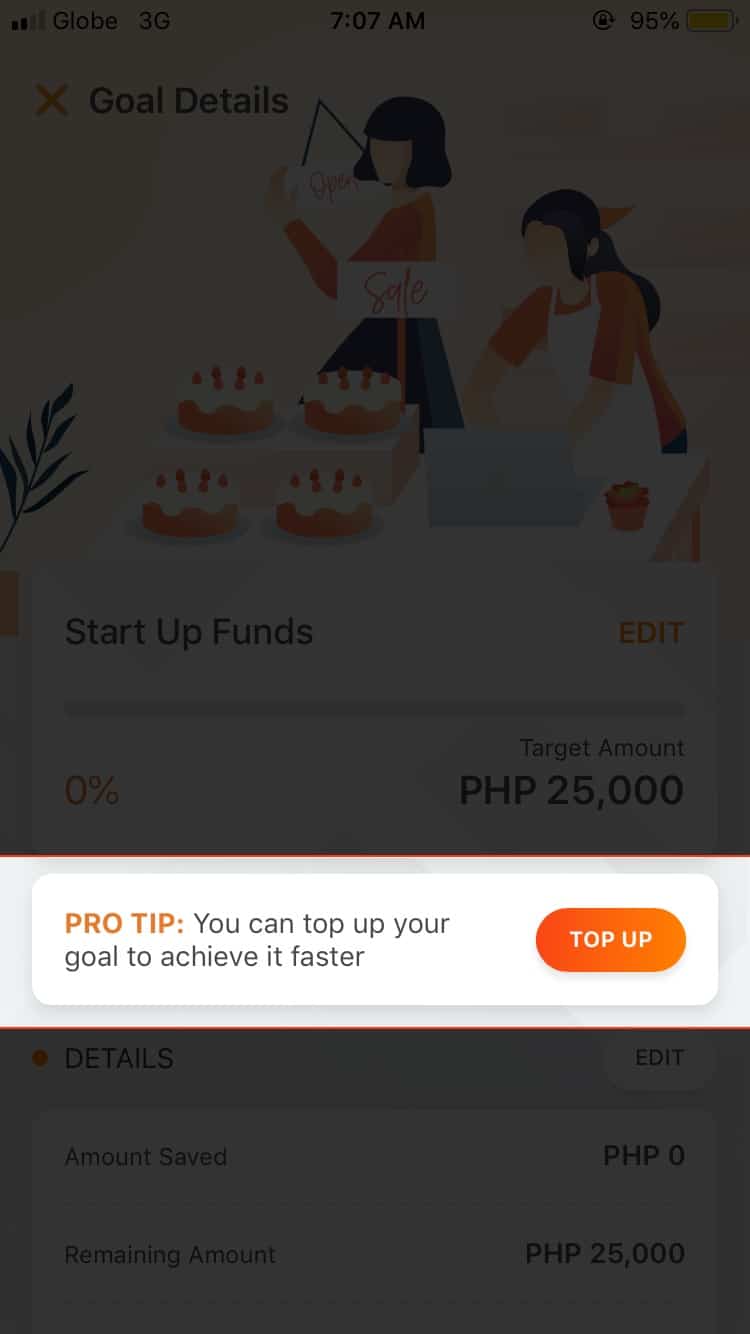

Review your Goal details

You can also top it up before or after your regular auto-debit if you have extra cash to speed up achieving your goals

- First, make sure you have a Unionbank account. ?? How to open a UnionBank Account on Mobile

- Sign in on the app or website.

- Under Goals, you’ll see “Start Saving Now”.

- Choose the goal you want to reach.

- Enter a name for your goal and set the amount you want to reach.

- It will ask you to set the saving frequency to weekly, monthly or quarterly.

- And you will choose the account to be charged for auto-debit.

- You’ll also set when your goal should start.

- The terms and conditions will show up for you to agree on.

- The last thing to do is commit yourself to your goal.

Let’s wrap up 2020 and be prepared for 2021

Lessons are learned in the past, the present should be lived at it’s best with a great mindset that will draw our future at its finest.

I honestly like this new feature. With this “Goals” feature, you can keep yourself up into saving and at the same time, you can track and focus on the progress of it.

Every time you save up you’ll see the completion percentage which for me is really encouraging.

Some of us may be broke after Christmas and some have a lot of collection from their kids’ pamasko, wherever you are right now, spend some time thinking about your goals. Long term or short as long as it is meaningful, go for it!

Look forward to what these goals can bring to you and your family.

This upcoming 2021, I’ll do my best to commit to my goals. For sure it is hard as hell, but we should always believe that we won’t move on unless we make a step. I’m thankful that Unionbank has a great team to come up with this idea.

And all in all, I’m thankful that God provided us a great opportunity to learn, be blessed despite challenges throughout 2020 and to welcome the new year!

For more posts, updates and promos don’t forget to follow us on social media and subscribe to our newsletters.

click here to send me Ko-fi

32 thoughts on “Kick Start Your Goals with UnionBank App”

Up to ilan yung pwede ilagay na goals? I tried it max na ba yung 3 goals lang?

Opo max na un

Would it have to be a real-life withdrawal like going to an ATM? or can it be transferred from the ‘goal’ back to the main account in your dashboard? also, do you happen to know the current interest rate of saving in union bank? thinking about making it my main savings account

hi thanks for droppin by. when you withdraw funds from your goals it will just go back to your main account. 🙂

Hi! I made a goal for myself, but for personal reasons, I dont need that goal na. I cant seem to delete it. Would you happen to know how?

If you have money there on your goal acct , withdrawing all balance will close it.

I’m thankful I saw your article. I’m encouraged to avail this feature now. Thank you!

Hi thanks for your thoughts I appreciate your comment.. I was encouraged to save up dn because of this feature too. I’ll forward for you to get started ?

Hi! How many goals can I create?

Hi I have 3 goals set up and there’s no option to add another one. So it means it is limited to 3.